Copper juniors moving towards new area play

Area plays, where one company makes a discovery then other companies rush in to stake all around them, are at the very foundation of junior markets. Some noteworthy area plays are Hemlo in 1982, Eskay Creek in 1990, Lac de Gras in 1992, Voisey’s Bay in 1995 and the White Gold Rush in 2010.

I alerted my readers to the developing gold rush in Canada’s Yukon Territory and said, in my opinion, buying Underworld Resources, Atac Resources and Kaminak Gold over the winter of 2009-10 and holding till fall 2010 drill results should work out very well. It did. Kinross Gold bought out Underworld in March 2010 (the transaction valued the fully-diluted share capital of Underworld at CAD$139.2 million). Atac went from a dollar a share in January, 2010 to over $8/sh. Kaminak entered into a buyout agreement with Goldcorp for $520 million in May of 2016, featuring its Coffee gold deposit.

A more recent area play occurred in the Australian Pilbara. Started by Novo Resources, in 2016-17 several explore-cos hit the ground running in and effort to replicate Novo’s discovery of gold-bearing conglomerates within a thick sequence of ancient sedimentary and volcanic rocks. At the height of the frenzy, in the autumn of 2017, the stocks of more than a dozen Pilbara gold explorers rose at least 24% within two weeks.

Many area plays concern gold, which is far from surprising given that gold is always in demand for (mostly) investment purposes, getting harder to find, and therefore commands among the highest prices of mined commodities – note that platinum group elements rhodium and palladium currently trade even higher than gold’s (as of Tuesday) $1,550/oz.

Lately copper is emerging as just as exciting a metal to chase, given its essential applications in construction (copper wiring, plumbing), power transmission, communications and most recently, electric vehicles. An electric vehicle is known to contain four times the amount of copper as a regular gas or diesel-powered model.

This article explores the current copper bull market – this week the red metal hit an 8-month high – and introduces readers to a copper belt of district-size scale, we believe we’ve tapped into, along with a few select companies conducting surveys and drilling for the next big copper mine.

Andean Copper Belt

The Andean Copper Belt runs from northern Chile in the south, through Ecuador and Colombia, then arcs northwest into Panama. It hosts some huge copper porphyry (and gold, molybdenum) deposits including Escondida, Chuquicamata, Las Bambas and Collahuasi.

The area’s geology is among the Earth’s most richly mineralized. The North Andean copper-gold province is a 2,500-kilometer mineralized arc that formed on the western edge of South America’s complex Proterozoic and Archaean shield, during the Lower Paleozoic era, around 300 million years ago. A complex of Cretaceous-era terranes (pieces of crust, broken from tectonic plates) was forged on the northwest margin of South America, connecting it to the southern tip of North America sometime between the Oligocene and Miocene epochs.

The largest copper-molybdenum porphyry deposits are at Cerro Verde-Santa Rosa, Cuajone, Quellaveco and Toquepala in southern Peru, and Mocha, Cerro Colorado, Spence and Lomas Bayas in northern Chile. Mainly copper porphyry deposits, with moly and gold kickers, occur in Chile at the Collahuasi, Quebrada Blanca, Chuquicamata, Escondida and El Salvador mines.

Under-explored parts

The Andean Copper Belt represents nearly half of the world’s copper production, but some of the parts underlying Colombia, Peru and Ecuador remain hugely under-explored.

Australia’s SolGold (TSX:SOLG) has had success in northern Ecuador, having discovered a new copper-gold-moly porphyry system at its Santa Martha target. SolGold continues to advance its Alpala deposit, located on the northern section of the Andean Copper Belt – which represents nearly half of the world’s copper production.

While there is just one producing copper mine in Colombia, in the northwestern department of Choco, the government is hoping to diversify from gold, oil and coal, into the red metal.

Recent geological studies found copper mineralization in not only Choco but Antioquia, Córdoba, Cesar, La Guajira and Nariño departments.

A 2016 peace agreement between the government and the largest Marxist rebel group has stabilized the South American country and opened it up to foreign investment. This has allowed Colombia to explore for minerals in previously inaccessible areas.

Major miner influx

Anglo American, AngloGold Ashanti, Cordoba Minerals and privately held Minera Cobre, partially owned by First Quantum Minerals, are among the companies exploring for copper (and gold) in the Andean Copper Belt.

In September 2018 Anglo American signed a joint-venture agreement with Luminex Resources, a Canadian company exploring for precious and base metals in Ecuador. Under terms of the JV, Anglo American can earn up to a 60% stake in Luminex by spending US$57.3 million between 2018 and 2024. This includes a $50 million investment in exploring Luminex’s Pegasus volcanic massive sulfide (VMS)/skarn deposit, plus a series of $7.3 million staged cash payments. Its ownership interest increases to 70% if Anglo American funds the project to a mining decision.

In December China’s largest gold producer, Zijin Mining, bought out Continental Gold for almost CAD$1 billion. The Canadian company’s Buriticá gold project in northwestern Colombia has a measured and indicated gold resource of 16.02 million tonnes at a gold-equivalent 11 grams per tonne, containing 5.32 million ounces of gold and 21Moz of silver. The mine has been under construction since 2017 and is expected to open next year, producing 250,000 oz per annum for 14 years.

Zijin also has a 24% stake in Guyana Goldstrike it acquired by way of a $3.2 million investment in the company. Guyana Goldstrike put the Zijin funding towards a trenching program at a new bedrock target at its Marudi Gold Project – Toucan Ridge – hoping to add to the other two mineralized zones, Mazoa Hill (where the 2018 resource estimate was completed) and Marudi North, where 2012 drilling added additional ounces.

Not to be outdone by its Andean neighbors, Peru is also ratcheting up mineral exploration. The world’s second largest copper producer wants to promote new investment in exploring Peru’s untapped mineral riches, and bump up its representative share of global exploration expenditures from 6% to 8% by 2021.

In November 2016, Canadian miner Teck Resources, valued around $11 billion, took control of the Zafranal copper-gold project in Peru’s southeastern Andes, through the purchase of AQM Copper. Japan’s Mitsubishi holds 20% of the property which has 621 million tonnes of 0.37% copper and 0.8 grams per tonne gold as of 2015, the most recent figures available. According to BNamericas, Teck has budgeted nearly $40 million for the $1.5B project this year, and plans to commission the mine in 2023.

Active juniors

Meanwhile, exploration companies continue to drill targets in Colombia, Peru and Ecuador, and court partners to help them to develop their projects further. The three companies presented here all offer potential entry points to copper juniors that are hunting for the red metal in the Andean Copper Belt.

Hannan Metals (TSX-V:HAN) is focused on its San Martin copper-silver project located about 30 km northwest of Tarapoto, Peru, in the Cordillera Ayu Mayo mountain range. The company considers itself a first mover in a new frontier basin-scale copper (chalcocite) district. Permit applications cover 38,400 hectares. Initial prospecting in 2018-19 identified high-grade mineralization in outcrops and alteration, within a 100 x 50-km area. Similar styles of outcrop boulder were discovered over a 100-km strike length. The best results from outcrops 20 km apart were 3 meters of 2.5% copper and 22 grams per tonne silver, and 2m of 5.9% Cu and 66 g/t Ag.

Having been explored for petroleum in the 1970s, the area contains a large data set that Hannan is using to interpret seismically defined basin structures, in the context of sediment-hosted copper mineralization.

Earlier this month the company was granted another 24 mining concessions at San Martin, and this week announced that Quinton Hennigh, a successful and well-respected geologist, has joined the board of Hannan Metals. Hennigh is CEO of Novo Resources, developing a conglomerate gold play in Western Australia. He has worked for major gold companies such as Homestake Mining, Newcrest and Newmont (now merged with Goldcorp), where he last served as senior research geologist in 2007. His exploration successes include Evolving Gold’s Rattlesnake Hills deposit, Nevada, and a gold find three miles north of ATV, also in Nevada.

Price per share $0.205, o/s 57,418,449, Market cap $11.7M,

Max Resource’s (TSX-V:MXR) two sedimentary hosted copper/ silvertargets are Cesar and La Guajira. The company also holds gold exploration licenses in the Choco and porphyry copper/ gold North Choco areas.

A crew at its Cesar copper project has been looking for surface outcrops, that Max thinks could be the tip of the iceberg of a giant sediment-hosted copper system below surface. If there’s an orebody at Cesar, underneath those outcrops, Max would be looking at a major discovery. The company has identified a 70 x 20-km copper-silver target area with up to 2% combined copper and silver. Eighteen structures identified over 9 square km indicate mineralization is open in all directions. Grades ranged from 0.3% to 4.2% copper and up to 116 g/t silver; 27 of 36 assays exceeded 1% Cu; 15 of the 43 more than 2% Cu; and 3 exceeded 3% copper.

Initial exploration at Cesar, a rock sampling program, reported grab sample assays ranging from 0.3% copper to 4.2% Cu, and 1 to 116 grams per tonne silver. Chip sampling results are expected soon. Recent photos from the site show visible copper oxide mineralization in samples.

At North Choco, rock chip samples collected over a one-meter interval returned an off-the-charts 49.8 grams per tonne gold and 4.3% copper. According to Max, the discovery could indicate the start of a new mineralized zone, considering that it is open in all directions and appears to be structurally controlled within the host rock.

Price per share $0.13, Market cap $2.06M, o/s 15,918,428

Aurania Resources’ (TSX-V:ARU)flagship asset is the Lost Cities – Cutucu project, found in the Jurassic Metallogenic Belt of the Andes foothills in southeastern Ecuador. The company has carried out stream-sediment reconnaissance on about 40% of the sprawling 208,000-hectare property.

Tracing copper-mineralized boulders over a strike length of 22 km, Aurania’s geologists observed the setting to be similar to the “Kupferschiefer” (copper shale) being mined by KGHM in Poland, ie. that copper leached from the sedimentary basin remains in solution because of the oxidized state of the red sandstones (“red-beds”).

Aurania also notes that data from the geophysics survey it flew over the project identified a number of magnetic centers that are interpreted as porphyries or porphyry clusters. If this interpretation is correct, the porphyries represent an additional significant source of copper potentially injected into the red-bed sequence.

Four bore holes have been completedat three epithermal gold targets, and a crew is expected to start drilling a fifth. Aurania recently raised CAD$5.2 million through a warrant exercise.

Price per share $3.95, Market cap $144.6M, o/s 36,600,000

Copper bull market continues

The US-China trade war has weighed on prices, not only of copper but other base metals such as iron ore and zinc, for going on two years, even as warehouse inventories drop and there is a chronic under-investment in new mines to replace depleted mineral reserves.

Things began to turn around in August, on heightened prospects of a trade war resolution between the world’s number one and two economies. China is the world’s top copper buyer, consuming around half of global shipments. Also, as central banks embarked on a path of monetary easing, including lower interest rates, demand for a number of raw materials including copper has been goosed.

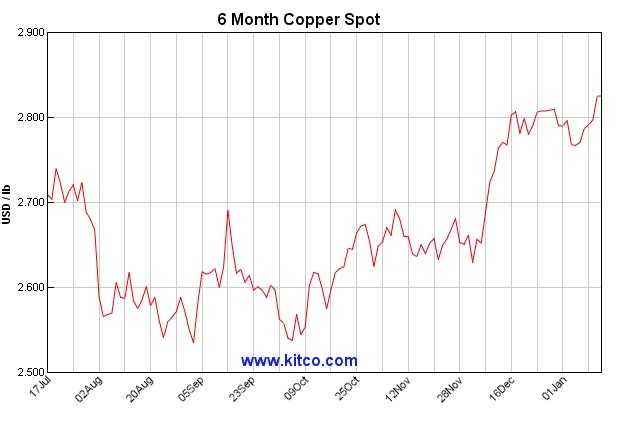

From its 52-week low of $2.51 a pound, copper has gained an impressive 13%, reaching an 8-month high of $2.86 a pound, on Monday, Jan. 13.

It’s not only the promise of increased demand from a trade deal (a phase one agreement was signed signed on Wednesday, Jan. 15) that has lit a fire under copper prices.

Warehouse inventories have been dropping; Europe and developed Asia have reportedly de-stocked aggressively over the past six months, as their economies improve.

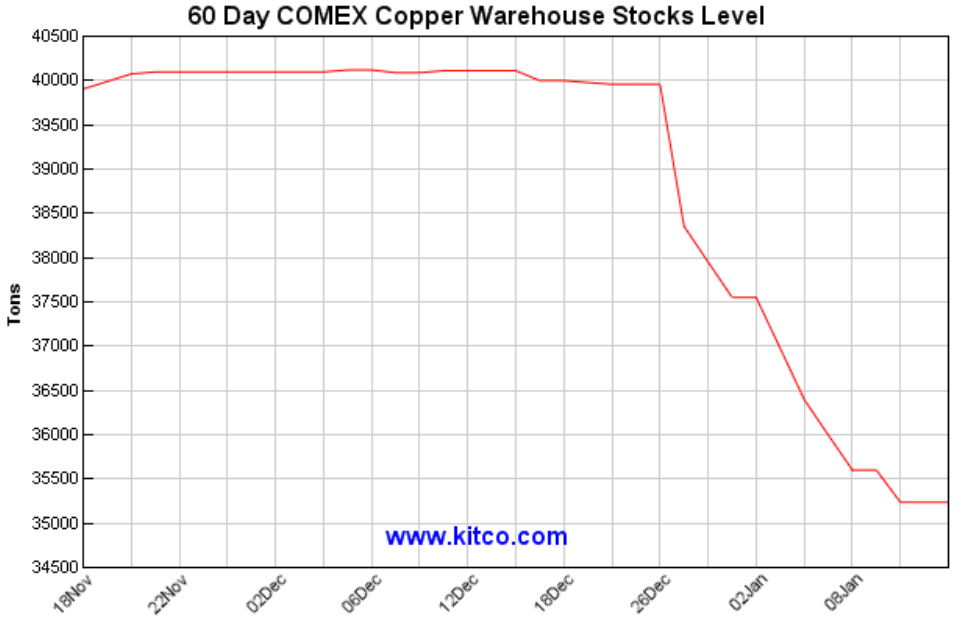

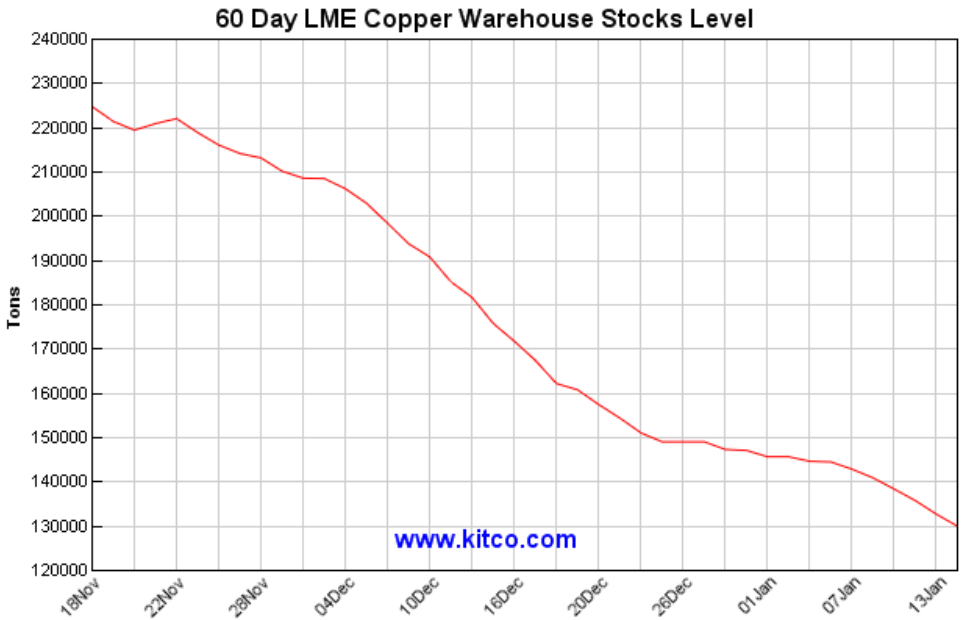

In New York, Shanghai and London warehouses, copper inventories have shrunk about 37% since July.

China’s purchasing managers index (PMI) – a key predictor of metals demand – expanded in December for the second straight month. Europe’s latest industrial output figures offer hope that its manufacturing slump has bottomed.

Between January and November of 2019, Chinese copper concentrate imports rose to 20.1 million tonnes, about 10% higher than the first 11 months of 2018. Trade data released this week shows imports of refined metal at their highest since March, 2016 and concentrate shipments setting a record high.

It’s a challenge for mines to keep up. The base metal is heading for a supply shortage by the early 2020s; in fact the copper market is already showing signs of tightening – something we at AOTH have covered extensively.

Supply is tightening owing to events in Indonesia and South America, where most of the world’s copper is mined.

Copper concentrate exports from Indonesia’s Grasberg, the world’s second biggest copper mine, have plunged dramatically as operations shift from open pit to underground.

Major South American copper miners have also been forced to cut production. State-owned Codelco has said it will scale back an ambitious $40-billion plan to upgrade its mines over the next decade, after reporting a drop in earnings, a prolonged strike at Chuquicamata and lower metals prices. The world’s largest copper company also said it will reduce spending through 2028 by 20%, or $8 billion.

Shipments from BHP’s Escondida mine were expected to drop by 85% in 2019 due to operations moving from open-pit to underground. The largest copper mine on the planet is expected to take until 2022 to re-gain full production.

These cuts are significant to the global copper market because Chile is the world’s biggest copper-producing nation – supplying 30% of the world’s red metal. Adding insult to injury, for producers, copper grades have declined about 25% in Chile over the last decade, bringing less ore to market.

Exacerbating falling inventories, grades and copper market tightness, Chinese smelting companies have reportedly indicated they will cut smelter output this year, burdened by low fees they charge mining companies to process copper ores.

Meanwhile demand for copper keeps going up and up. Copper products are needed in homes, vehicles, computers, TVs, microwaves, public transportation systems (trains, airplanes) and the latest copper consumable, electric vehicles.

In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations.

The IEA forecasts a more than quadrupling of EV sales in the next decade, from 5.1 million in 2018 to 23 million in 2030. Research quoted in Barron’s said the mining industry will need to produce 5 million tonnes of copper a month by 2030, which is about 2.5 times the amount produced this year, just to meet demand from EVs.

The bullish copper fundamentals have several international banks predicting copper demand and prices will keep rising. Citigroup is predicting a 2.6% jump in Chinese copper consumption next year, due to investments in the power grid and fresh automobile demand. BMO and Goldman Sachs, the renowned investment bank, are most sanguine on the copper market, with Goldman seeing prices heading to $3.17 per pound in 2020, and BMO forecasting a long-term copper price of $3.25/lb.

Conclusion

This “Andean copper area play”, if we may call it that for now, is developing within a trio of countries in northwestern South America – Colombia, Ecuador and Peru – that all have one thing in common: copper, silver and gold.

Peru and Colombia are already experienced mining countries so there should be the required human resources and infrastructure available, as exploration there continues to increase. Ecuador has a lot of untested ground left to uncover, thus tremendous opportunities.

The three companies featured in this article are chasing copper, silver and gold at the perfect time, as investor sentiment comes back around to the red metal amid dropping mine output, lower copper grades and shrinking warehouse inventories. Meanwhile copper demand continues to soar, for its usual applications in construction, communications and power generation, and lately, cutting-edge technologies like EVs and 5G networks.

As the copper shortage becomes more acute, prices will have to head higher.

In this bullish environment, we believe the Andean Copper Belt is the next big copper area play, we think a lot of players, both big and small, are going to be involved and we expect a lot of news flow to come out of companies operating in this region.

All that news flow is good for all area play participants/ companies. Soon, seemingly not a single day will go by without a news release about another company staking claims and citing recent exploration and drill results from Max Resources, Hannah or Auriana as the reason why. These 3 juniors are first movers and their recent exploration success will ignite considerable interest in Copper’s Next Frontier, the San Andean Copper Belt, and in the market.

The importance of these discoveries cannot be overstated in the context of South American exploration and the markets in general. This kind of good news can excite the market for the entire junior copper, silver and gold exploration sector. Also, area plays, where one company makes a discovery, then dozens of other companies rush in to stake all around them, are one of the very foundations of our junior markets.

As the story of the San Andean Copper Belt unfolds I believe we can expect exciting times for those investors who get involved with the various companies participating in, what still are, very early days of this developing area play.

Source: Mining.com